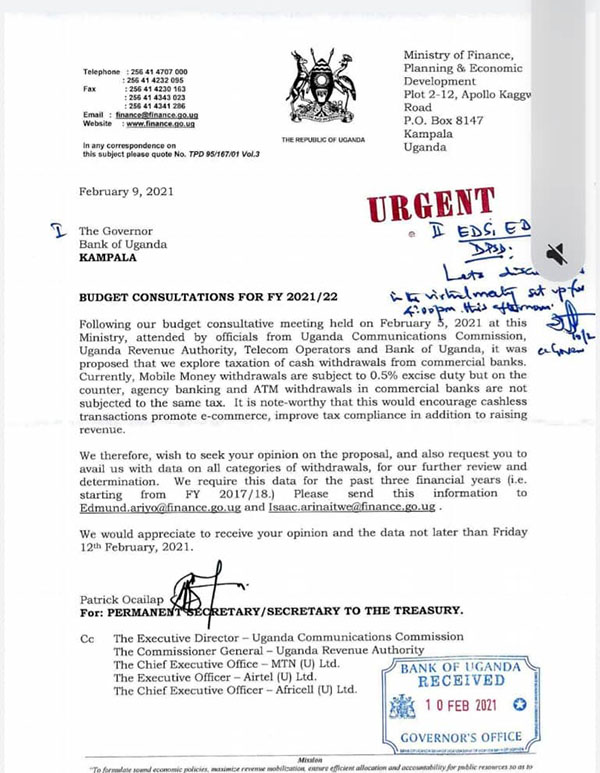

In what Ministry of Finance termed as promoting E-Commerce, improving tax compliance and raising more revenue, government is planning to levy taxes on cash withdrawals from commercial banks.

The Finance Ministry has therefore written to Bank of Uganda seeking an opinion and data not later than Friday 12th February.

Patrick Ocailap a top official at the Ministry of Finance told the Central Bank Governor Emmanuel Tumusiime Mutebile that the move was discussed in a budget consultative meeting held on 5th February, attended by Uganda Commissions Commission, Telecom Operators, Uganda Revenue Authority and Bank of Uganda.

“It was proposed that we explore taxation of cash withdrawals from commercial banks,” the letter written on Tuesday February 9, reads in parts.

The letter adds: “Currently, Mobile Money withdrawals are a subject to 0.5% exercise duty but on the counter, agency banking and ATM withdrawals in commercial banks are not subjected to the same tax.”

Mr Ocailap said the Ministry of Finance requires data of the past three financial years for analysis.

However, this plan has already attracted public backlash with many anticipating the collapse of banks as people are likely to keep cash in their homes.