Parliamentary Committee on Commissions, Statutory Authorities and StateEnterprises (COSASE) has summoned a private auditing company Price WaterCoopers (PwC Uganda) to explain how it reached on shs 239 billion undercapitalization figure of closed Crane Bank.

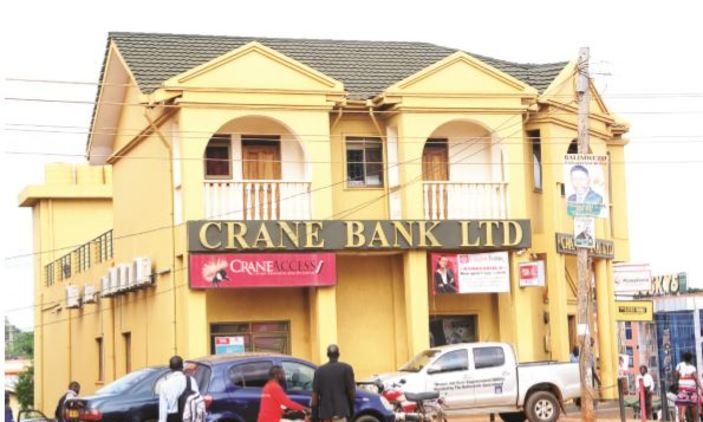

Crane Bank which belonged to tycoon Sudhir Ruparelia was sold to DFCU in 2017 by the Central Bank.

The committee zeroed on Price Water Coopers after BoU officials for the second time failed to explain the extent of Crane Bank’s undercapitalization when the Central Bank took over as statutory managers.

“That document was written by PwC and PwC will be called to explain,” Katuntu said.

Price Water Coopers was the audit firm that was contracted by BoU to carry out an inventory of the assets and liabilities as well as a forensic audit of Crane Bank upon its takeover on 20th December 2016.

The committee has also learnt that BoU reached a decision to close crane bank after they failed to fulfill the first directive of recapitalizing the bank with Shs32bn by September 2016 and they could only manage to raise Shs27bn. In total, Crane Bank needed Shs157bn to take it back to the required level of capital.

BoU Deputy Governor, Louis Kasekende asked the committee to give them time to provide a preliminary report after the Mbarara Municipality MP Micheal Tusiime claimed that they favoured Dfcu in the bidding process to sell Crane Bank.

“For PwC to arrive at those losses, they should have made an extract from that income statement, if we don’t have that attachment, we can’t verify especially if the previous year, they had made profits of 52Bn. We shall require the general ledger and income statement for the year under review,” Tusiime said.

Tusiime added that there is a possibility that Dfcu connived with Central Bank to fraudulently give them the bid to buy Crane Bank just like they did on Global Trust Bank (GTB).

“Dfcu submitted a bid a day before the inventory was handed to BoU. The content of the bid is a replica of what was in the report. Where could Dfcu have got details of the inventory before it was handed to Bank of Uganda?” he asked.

“It is clear that Dfcu had prior knowledge of the inventory even before it was submitted to Bank of Uganda because on 21st December 2016, the inventory report was submitted to BoU, but on the 20th December 2016 Dfcu submitted its bid with contents of the inventory report which you [BoU) received on 21st,” Katuntu said.

The committee will resume the probe on Thursday with hopes of winding up the process that has lasted for about a month now.