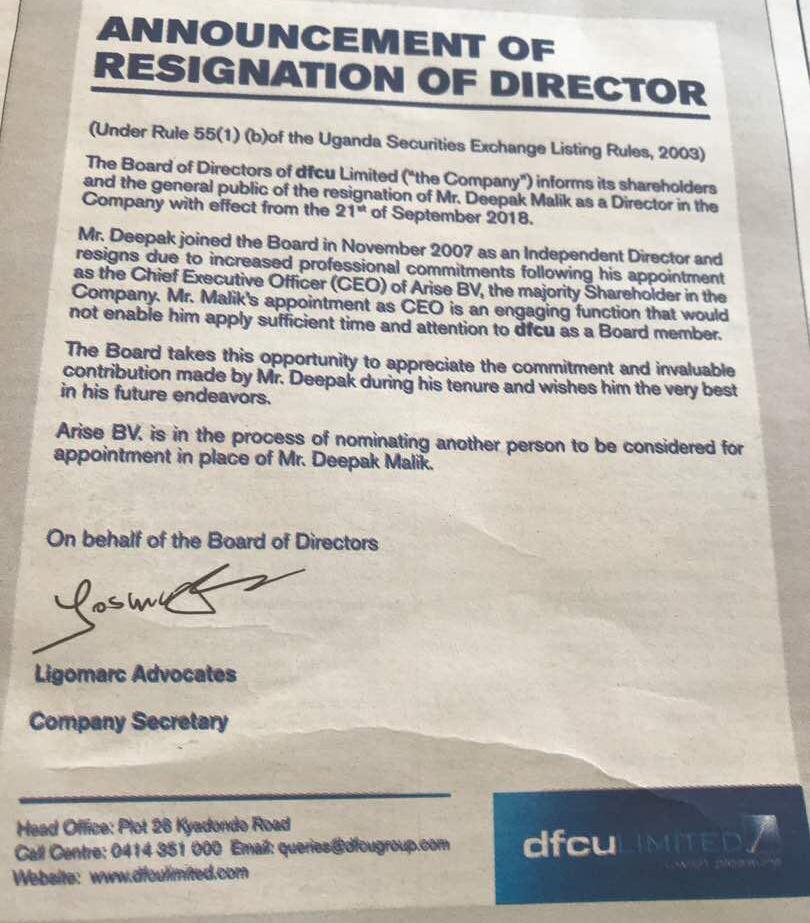

Deepak Malik who has been serving as board director of DFCU bank has resigned.

In a memo seen by this website, Mr. Malik ceased being a board member on September 2, 2018.

“The board of directors of Dfcu (the company) informs its shareholders and general public of the resignation of Mr Malik as a director in the company with effect from the 21th of September 2018. Mr Malik joined the board in November 2007 as an independent director and resigns due to increased professional commitments following his appointment as the Chief Executive Officer of AriseBV, the majority shareholder in the company”

Reports arising from the financial institution indicate a number junior managers at the bank have thrown in the towel protesting the hiring of a Kenyan Human Resource firm amid the restructuring process.

Malik also serves as the Head of Department – Financial Institutions and part of the management team at Norfund.

Malik’s resignation as a non executive director means the Dfcu board is now left with five other non-executive directors led by All Elly Karuhanga as Chairman. Others directors are; Albert Jonkergouw, Winifred Tarinyeba- Kiryabwire, Frederick Kironde Lule and Michael Alan Turner.

Analysts say the Malik’s decision to resign confirms reports that Arise B.V. intends to leave especially that Britain’s Commonwealth Development Corporation (CDC) Group intends to exit, following Dfcu Bank’s controversial acquisition of Crane Bank Limited in January last year at only Shs200 billion yet Crane Bank had assets worth over Shs1 trillion.

Reports indicate that CDC is leaving for various reasons which include poor economy but some sources say CDC wants to dodge paying taxes on its dividends. Other sources intimated to Eagle Online that top executives at Arise B.V. decided to plan exiting Dfcu Bank in fear that CDC was leaving them trouble, they being new and majority shareholders of Dfcu Bank.

Financial analysts say with the revelation by Auditor General that Dfcu acquired Crane Bank Limited and yet it was the valuer and at the same time a buyer could land top Bank of Uganda executives in trouble as big shareholders of Dfcu are spending sleepless nights. The situation is made worse as the case is also in court.