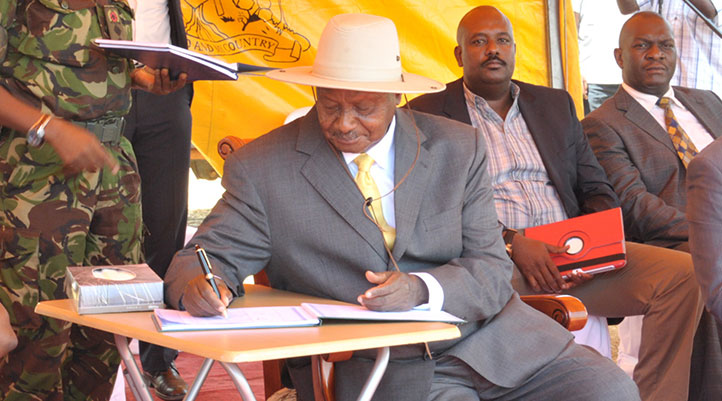

President Yoweri Museveni has declined to sign another controversial tax bill-the Tax Procedures (Amendment) Bill, 2018 that was passed by Parliament in May this year.

This was on Tuesday revealed by Deputy Speaker Jacob Oulanyah during a plenary sitting. Oulanyah told MPs that President Museveni had written to the Office of the Speaker requesting Parliament to reconsider the Bill.

“The President says that the Bill in its current form will lead to some persons or organisations not paying tax,” Oulanyah said.

In his letter to the Speaker, Museveni is quoted as saying, ““In accordance with Article 91(3b) of the Constitution, I hereby return the Tax Procedural Amendment Bill 2018 to Parliament. Section 20(6) should be re-considered and deleted… Incorporating it in the Act will encourage non-compliance by the tax payers as regard to filing the annual tax…The current tax system[that] compels taxpayers to pay taxes through self-assessment has been effective. Therefore, the proposed amendment will further deter URA from charging interest on tax arrears hence creating revenue leakages.”

The object of the Tax Procedures (Amendment) Bill, 2018 that was passed in May this year is to amend the Tax Procedures Code Act, 2014, Act No. 14 of 20l4 to provide for due dates for filing returns under the Lotteries and Gaming Act, 2016; to provide for the Minister to pay taxes on behalf of a person; to waive all unpaid taxes due and unpaid by government as at 30th June 20l8; to provide for electronic receipting and invoicing; and to provide for penal tax relating to electronic receipting and invoicing.

Section 20(6) of the Tax Procedures (Amendment) Bill, 2018 states that, “Where a tax payer files returns with the Authority and an assessment is done by the Authority within a year, interest on the monies due from the period of assessment shall accrue from the date on which the assessment was conducted.”

Museveni’s rejection to Tax Procedures (Amendment) Bill, 2018 comes days after he made a U-turn on the controversial Excise Duty (Amendment) Bill, 2018 that was passed by Parliament to allow a 1% levy on all transactions on mobile money and Shs200 daily on Over The Top (OTT) social media services.

Article 91(3) of the 1995 Constitution states that the President shall within thirty days; (a) assent to the Bill; (b) return the Bill to Parliament with a request that the Bill or a particular provision of it be reconsidered by Parliament; or (c) notify the Speaker in writing that he or she refuses to assent to the Bill.

Clause 4 & 5 of the same article adds that, “Where a bill has been returned to Parliament under clause (3)(b) of this article, Parliament shall reconsider it and if passed again, it shall be presented for a second time to the President for assent. Where the President returns the same bill twice under clause (3)(b) of this article and the bill is passed for the third time, with the support of at least two-thirds of all members of Parliament, the Speaker shall cause a copy of the bill to be laid before Parliament, and the bill shall become law without the assent of the President.”