Advertising is an important element for companies, especially ones that sell fast moving consumer goods (FMCG). Huge budgets are lined at the start of the year to publicise products, announce promotions and run consumer campaigns.

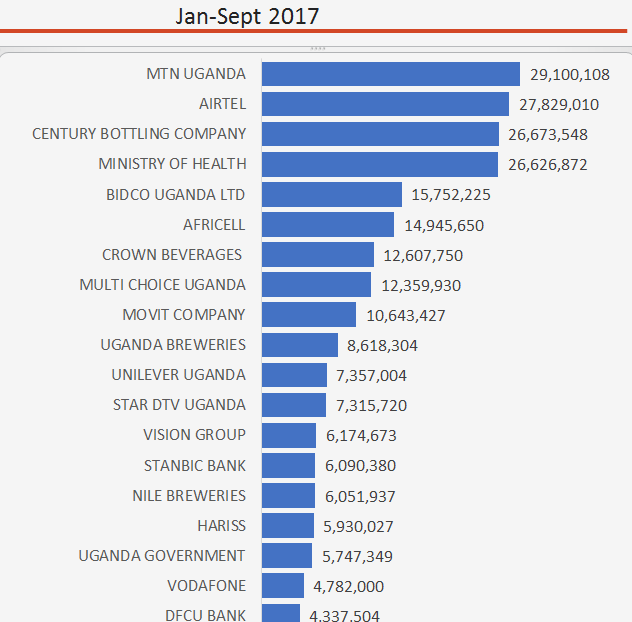

In 2017, over 445 billion shillings was spent by the 20 top advertising companies in Uganda on majorly radio, followed by television with print and digital advertising coming in at the bottom.

55% of the 445 Billion spent in advertising between January and September 2017 was spent on Radio, while Television garnered 28% and Print (Newspapers) took a paltry 17%.

Top Spenders Revealed

MTN Uganda took the top spending position splashing over 29 billion on ads, followed by their arch rivals Airtel who spent two billion less at 27 billion.

Soda manufacturers Century Bottling came in 3rd with a 26 billion shillings ad spend, a similar amount spent by the Ministry of Health.

Africell who are keen on making their mark on the market spent 14 billion, while Crown Beverages, the makers of Pepsi products and Digital television market leaders Multichoice each spent 12 billion.

Movit Company, Uganda Breweries and Unilever spent 10B, 8B and 7B respectively completing the list of the top 12 spenders.

Value for money flops

Advertising is meant to woo consumers to buy into products thus earning companies money in sales. But, huge spend on advertising does not necessarily turn into sales, or value for money.

Among the top 20 spenders in 2017, Africell led the lot as of the top companies that did not get back their returns from the enormous spending.

Having spent over 14 billion on advertising (excluding outdoor) which isnt monitored and is not captured in this figure, the Lebanese owned telecom is still struggling to catch up with market leaders MTN who have over 9 million Subscribers, Airtel with 8 million and spent 29 and 27 Billion shillings respectively.

Africell reportedly has a paltry 1.2 million subscribers spread mostly in the rural areas with low spending power, and a minimal number in the urban areas where they are praised for their reliable data services.

The negative balance sheet continues to affect Africell and could be the reason the man charged with their commercial direction, Milad Khairallah-former Commercial Director was moved to DRC where he will head Operations.

Others with an unbalancing sheet include Vodafone who are at the verge of closure even after spending over 4 Billion on advertising, but with just 100,000 subscribers.

Hariss International– the makers of soft and energy drinks even with a 5 Billion spend failed to make any impact against their biggest competition-Crown and Century Beverages, while Uganda Breweries who spent 2 billion more than their biggest rivals Nile Breweries at 6 Billion shillings trailed the alcohol industry with 40% market share.

BIDCO who spent 15 Billion Shilings– nearly double the amount unleashed by their biggest rival Unilever at only only 7 Billion still failed to make any impact.

Star Times spent over 7 Billion with little impact against Multichoice, while Stanbic Bank who spent 6 Billion made no impact over DFCU Bank who let out 4 Billion Shillings.

With the increasing cost of doing business, chances are companies with cut back on advertising spending in 2018 as they seek other cheaper ways to keep their businesses top.