Equity Bank has come under fire to explain how a customer, Edith Nakacwa’s deposit(s) amounting to shs 21 million was withdrawn from her account through e-banking (eazzy funds transfer) without her knowledge.

The shocking incident occurred in April, 2021. Having admitted that indeed money was withdrawn by unknown people, the bank promised to refund.

Four months down the road, Nakachwa is yet to see a single coin, get an explanation on what caused the delay or who was responsible for the fraud inside the bank.

But instead, the bank officials, according to Nakachwa blasted her for attempting to ‘taint’ Equity’s image by running to social media ‘to seek justice.’

In her confession, Ms Nakacwa details how her money would be withdrawn in installments to a tune of shs 21,950,000 million shillings.

She suspects the fraudsters collaborated with bank staff to sweep her account clean, the funds were meant to facilitate her start-up business which has since collapsed.

Nakacwa’s Agony

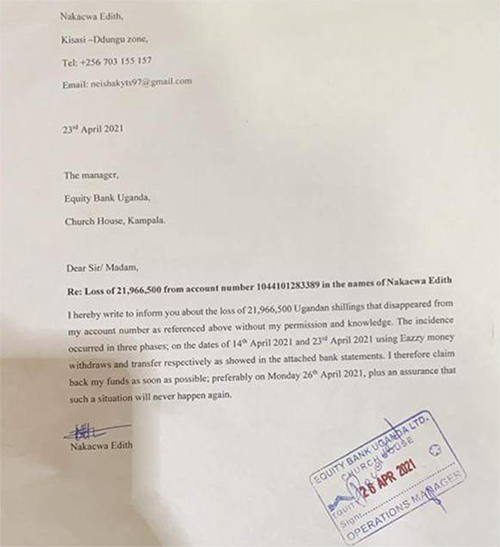

My name is Nakacwa Edith, I hold a savings account (a/c 1044101283389) with Equity Bank which I opened in 2019.

From that time, I had never had any issues with the bank until April this year.

Every transaction I made I would get a notification on my phone number- 0703155157- which I used while opening the account.

I would make transactions above shs 1,000, 000 at the counter and less than that on ATM or through an agency banking.

On 23rd April 2021, I went to withdraw money from an agent on Kampala road who told me I didn’t have enough on my account.

I was so shocked because the previous day, my account was credited with shs. 1.7 million.

I went to Equity bank head offices at church house to find out what exactly happened.

At the head offices, after checking the system, management told me that I transferred shs 9.5m through eazzy funds transfer to someone called Flavia Adongo using a phone application.

I have never known Flavia Adong in my life, neither have I used or downloaded that application on my phone.

I told the bank that, whereas shs 9.5 was withdrawn, I still had much more money.

The lady who was working on me referred me to the head of security.

While in his office, Mr Denis Obua confirmed that it was a fraud.

While in his offices five similar complaints had been registered on that day.

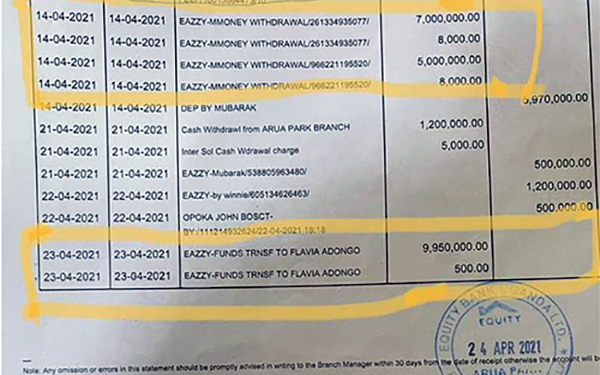

He brought me my bank statement where I found out that more transactions happened without my knowledge.

I found out that the first transactions on my account was 7,000,000 million shillings and 5,000,000, were carried out on 14th April and money was transferred to phone numbers.

The total amount stolen was 21,950,000 million exclusive of bank charges.

He also confirmed that the bank is responsible for the loss and that the matter would be resolved soon.

He told me to go back on Wednesday.

Upon returning, Mr Obua said he was yet to present my case to the board and was likely to do so that day.

He would then give me a call. He never called.

The next day (Thursday), I got bank notification that shs 500,000 being was withdrawn from account.

On getting the message I immediately called Mr Obua and I told him everything and he promised to call me back but didn’t.

It should be noted that I never received any notification of the previous transactions.

I kept waiting for Mr Obua’s call in vain until I decided to tweet about it on Saturday and tagged the bank.

When I went back on Monday, I was scolded for tweeting.

Mr. Obua made it clear to me that Equity bank is a very big institution and that my money was so little and would be paid in a blink of an eye.

He said that, I should instead ask Twitter to refund me.

I told him I have all rights to use whichever means I thought would help to get my money and I assured him I was going to sue.

Mr Obua laughed off saying I stood no chance of winning a court case.

He handed me to a lady, a one Doreen to handle my issues and she would report to him.

Doreen picked my calls for only one week, after that I couldn’t hear from her.

I took my misery to Twitter, and a few tweets, the bank called me that management is aware of my issues and were being worked on

However, what followed were excuses each time I called. They told me to call once a week and they would give me heads-up on what was happening.

They told me that my case was forwarded to Kenya for payment approval.

The following week I was told my case had to be looked at by the board of directors and the Managing Director has the final say.

After those excuses I still got nothing.

So I decided to get a lawyer who wrote to Bank of Uganda, copied in Equity Bank,

Bank of Uganda replied in a week saying it would invite us.

In the process the country was put under lockdown and Bank of Uganda postponed the meeting.

After the lockdown my lawyer again wrote to bank of Uganda. BoU promised to call us which has not happened.

My savings were my capital. I lost everything.

I can’t pay rent at my work place nor where I stay.

I am surviving on the mercy of my friends and a few family members.

I am stuck and I don’t know what to do.

It’s coming to four months and Equity Bank is still silent.

My small business which I had just started collapsed, I am back to zero.