The telecommunications industry recorded gross revenue of more than US$1bn in the 12 months ending December 2020, the latest communications market performance report indicates.

According to the quarterly market tracking report produced by Uganda Communications Commission (UCC), UShs1.144 trillion was recorded for the October – December 2020 quarter, surpassing the UShs1.095 trillion recorded in the third quarter (July to September 2020).

In 12 months, the industry grossed $1.007bn or UShs 3.5 trillion, making it the first time that the annual telecommunications sector revenues had crossed the US$1bn mark.

“The record performance was attributed to sustained growth in digital and mobile financial services, jointly accounting for more than 39% of total quarterly revenues,” the report states.

The record telecommunications industry revenues are just one of several highlights in the report that is littered with new performance records across all major market monitoring metrics. Other notable indicators include a record rise in domestic minutes of talk, internet downloads and mobile money transactions.

On domestic voice traffic, the market posted record volumes, recording 14.8 billion minutes in the months October to December 2020. This surpassed the earlier set domestic quarterly traffic record of 14.4 billion in the months July to September by more than 370 million minutes of talk. This performance translates into an average of 177 minutes per month for every active line.

As for new fixed and mobile subscriptions, the market posted 1.3 million during the quarter under review in spite of the COVID-19 pandemic and the resulting low-key holiday season devoid of the customary influx of Ugandans from the Diaspora associated with the end of year holidays.

When compared to the 1 million new subscriptions recorded over the same period in 2019, the 1.3 million new fixed and mobile subscriptions recorded in the months October to December 2020 translate into a year-on-year growth of 4%.

This performance, coming on the backdrop of a 3 million subscriber erosion at the height of the COVID-19 lockdown in the second quarter (April to June 2020), points to a remarkable post-COVID-19 recovery in the sector.

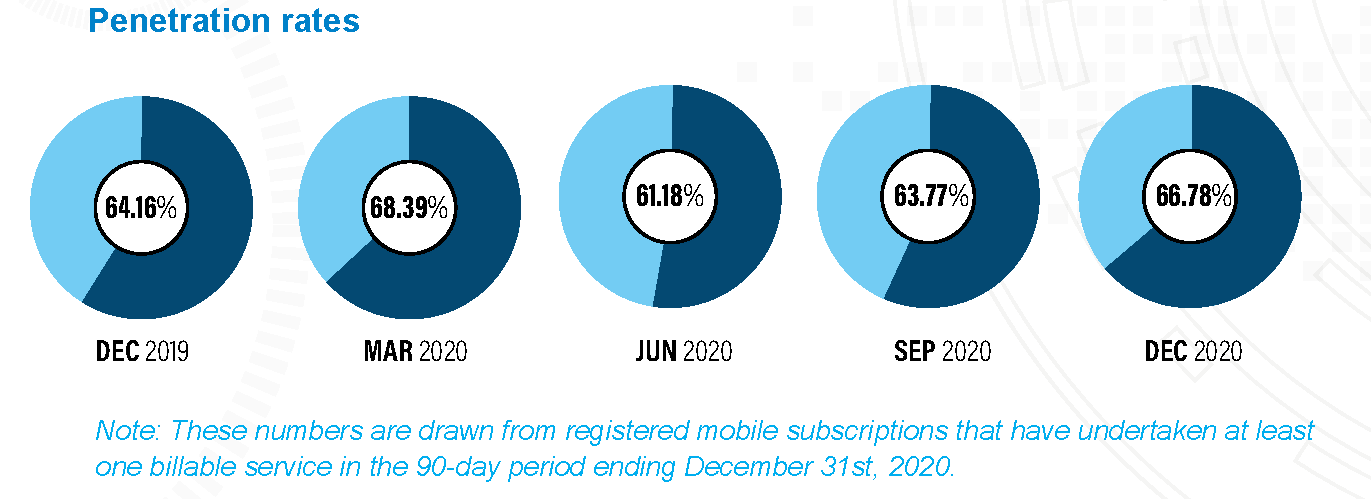

Moreover, the growth in subscriptions has resulted in an increase in service access with the number of lines available to every 100 inhabitants jumping from 64 lines in September 2020 to 67 lines per 100 individuals at the end of December 2020.

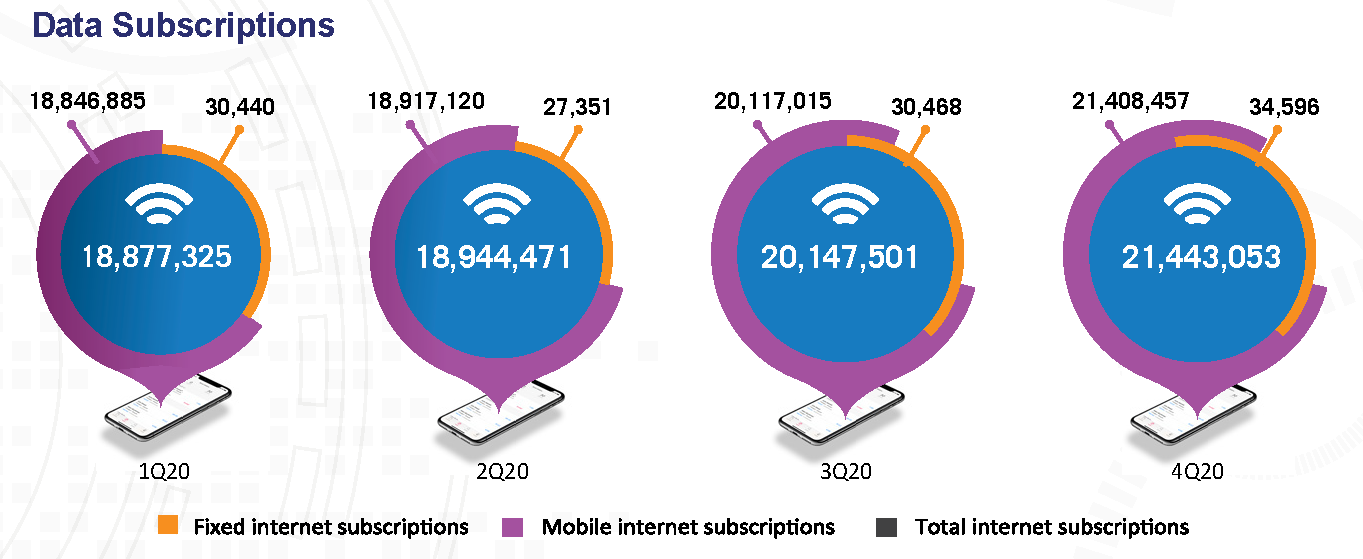

The report further points out that for the second quarter running, the market posted a growth of more than 1.2 million new internet connections. The bulk of these were on mobile, accounting for more than 98% of new internet connections.

Accordingly, by the end of December 2020, the number of active internet subscriptions had grown to 21.4 million, translating into an internet access reach of more than one (1) active connection for every two (2) Ugandans.

On the other hand, mobile money accounts failed to live up to the record set in the third quarter (July to September 2020) when 1.8 million new mobile money accounts were registered. In the fourth quarter, it was a subdued 325,000 new mobile money accounts.

Nevertheless, this subdued growth translates into a national mobile money account total of 28 million, up from 27.7 million accounts at the end of September 2020. This further translates into a national mobile money penetration of 66 accounts per 100 persons in Uganda.

Besides, the number of mobile money transactions during the quarter crossed the 1 billion transactions mark for the first time ever, surpassing the previous quarterly record of 954 million transactions posted in the months July to September 2020.

This translates into an average of 15 transactions per active mobile money account every month, including agent-assisted deposits, mobile money bank transfers, mobile betting, and merchant payments, among other transaction categories.

The volume of broadband traffic recorded during the fourth quarter is yet another record metric captured in the report, having grown to 71.5 Billion MBs, up from the 59 Billion MBs posted in the third quarter. These figures represent a quarter-to-quarter broadband demand growth rate of 11%, outperforming the 6% growth in broadband subscriptions.

The sharp increase in downloads per user is a pattern that has been witnessed in other markets too, following COVID-19 driven changes in the way people work, entertainment and education, among other aspects of life impacted by the pandemic.