Historically, gaming has carried a mixed and often uneasy reputation, swinging between tolerance, suspicion and outright stigma depending on the era and society. In many communities it is shunned on religious and moral grounds, yet it is rarely treated as a serious economic sector or a subject for thoughtful public policy. For a long time, the popular image of gaming and lotteries was one of dark, dingy rooms filled with smoke and whispering bettors. Today, much of that activity has moved into a bright digital expanse that fits in the palm of a hand. Governments stepped in to manage gaming and did so because unmanaged growth created risks to players, public revenue and social trust.

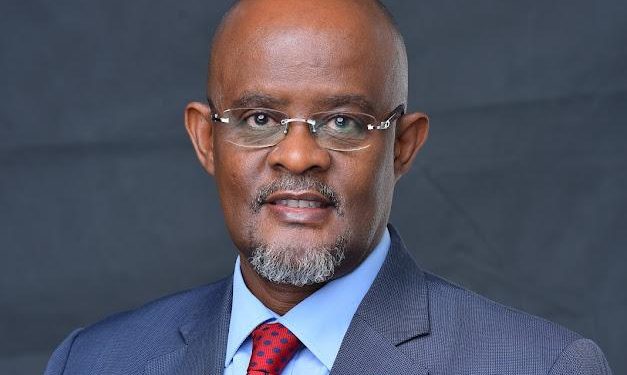

It is into this long and sometimes uneasy global story that I now step as the Chairperson of the National Lotteries and Gaming Regulatory Board. After more than twenty-five years working across East Africa’s capital markets and broader financial services, I find myself leading a sector that has travelled a similar journey from moral suspicion to data-driven oversight. Coming from the private sector, I was struck by how modern and connected Uganda’s gaming regulatory framework has become, with systems and people that in some respects rival those I encountered in corporate finance.

That experience has convinced me that the way we regulate gaming and the way we regulate capital markets are more closely linked than many Ugandans might assume.

Shared foundations

By December 2025, Uganda’s capital markets and its licensed gaming industry were each generating multibillion-shilling turnover annually and contributing formally to government revenue and household economic activity. Capital markets channel long-term savings into companies and public infrastructure. Gaming relies on short-term discretionary spending, money that individuals choose to risk on games of chance. The risks differ, but the regulatory task is familiar. Both sectors require clear rules, effective enforcement and serious risk management.

Public perception, however, has not kept pace with this reality. Capital markets were for years viewed as a distant preserve of elites, poorly understood and underutilised until the growth of unit trusts during the Covid period broadened participation. Gaming, on the other hand, remains trapped in a moral debate that often ignores its economic scale, technological sophistication and operational complexity.

Each sector has something to teach the other. Capital markets bring long experience in disclosure, governance, investor protection and anti-money-laundering controls. Gaming has advanced rapidly in transaction monitoring, telecom integration and the analysis of vast volumes of low-value transactions. These capabilities can inform modern surveillance, enforcement and consumer-protection approaches across both domains. Regulation, in either case, is not about stifling innovation. It is about managing risk, preventing harm and protecting the integrity of the system.

Enforcement and access

The differences between the two sectors become most visible in how people gain access. In capital markets, access is mediated through licensed gatekeepers such as brokers, fund managers, advisers, custodians and the stock exchange. An investor must open an account, complete identity checks and leave a digital trail within a central depository or registry. Enforcement therefore concentrates on these intermediaries and the products they distribute. The process can be slow and legalistic, but that is the price of due process and investor protection.

Gaming operates at the opposite end of the spectrum. A punter with a basic mobile phone and a mobile-money account can place a bet within seconds, without an adviser or intermediary. That ease of access is part of the sector’s appeal, but it also means that enforcement must be more immediate and visible. The Board must combine data analysis with physical inspections, seizure of unlicensed machines, blocking of illegal websites and joint operations with the Police, URA, UCC, the Judiciary and the ODPP.

During routine inspections, officers often encounter small neighbourhood outlets operating without a licence. Machines are installed quietly, collecting bets from regulars who view the activity as harmless entertainment. What is often missing is not demand, but oversight: no age verification, no player protection and no contribution to public revenue. That gap between informal activity and regulated participation is where harm takes root, not through dramatic events but through daily, unchecked transactions.

The enforcement postures differ, but the objective is the same. Whether dealing with securities or sports betting, regulation exists to keep out bad actors, protect players and ensure that participation takes place in an environment worthy of public trust.

Mandate, growth and shared risks

Uganda’s capital markets have grown steadily from a small exchange with few listings into a more diversified ecosystem that includes corporate bonds, collective investment schemes and dual listings. Cooperation between the Capital Markets Authority, the Uganda Securities Exchange and the Central Depository has strengthened transparency, settlement and oversight.

The gaming sector has experienced far more compressed growth. Today, the NLGRB oversees more than fifty licensed operators across lotteries, casinos and sports betting. The Central Monitoring System provides visibility into gaming activity, improves compliance with taxes and fees and enables more targeted supervision. It has reduced illegal operations and encouraged a stronger culture of compliance among licensed operators.

Anti-money-laundering obligations sit at the centre of this effort. Just as securities firms must know their customers, identify beneficial ownership and monitor unusual activity, gaming operators are increasingly expected to apply similar risk-based controls. Techniques long used in capital markets, such as pattern recognition and risk scoring, can be adapted to gaming. At the same time, gaming’s experience with high-frequency transactions and telecom-level integration offers lessons for supervising digital investment products.

Digital change and the need to keep pace

Digital transformation has expanded access in both sectors. Investors can now buy units in collective investment schemes or government securities using mobile phones. Gaming platforms rely on the same payment rails to reach millions of users. This low-friction access supports inclusion, but it also accelerates the speed at which harm can occur and raises questions about data protection, digital identity and responsible behaviour.

Regulatory frameworks do not always evolve at the same pace as technology. For this reason, carefully designed regulatory sandboxes have value. In gaming, these could allow controlled trials of stronger responsible-gaming tools such as dynamic spending limits or improved self-exclusion systems. In capital markets, they could support innovation in digital savings products or new advisory models under close supervision. Sandboxes allow regulators and innovators to learn from evidence rather than assumption.

Behaviour, literacy and public interest

True financial literacy is not about memorising product names. It is about understanding risk, probability and consequences. In capital markets, it helps distinguish long-term investment from speculation. In gaming, it reinforces the idea that betting is entertainment, not a financial strategy.

During outreach activities, the Board frequently encounters individuals chasing a single transformative win. Some bet beyond their means or continue playing to recover losses. This behaviour mirrors speculative cycles in financial markets. It raises an important question: why do many who readily place multiple bets hesitate to invest small, regular amounts in long-term savings products that offer far greater security over time?

Responsible gaming, in simple terms, means using only money one can afford to lose and knowing when to stop. Borrowing to bet, hiding losses or sacrificing essentials such as rent, school fees or medical care are warning signs that require intervention. Regulators across gaming, capital markets and insurance share a duty to promote prudence, self-control and informed decision-making.

Bringing financial literacy into responsible gaming policies can support healthier behaviour. At the NLGRB, we see opportunities to work with other regulators, telecom companies and educational institutions to embed simple educational tools directly into gaming platforms and mobilepayment systems. including spending alerts, budgeting and self-exclusion. Investment and insurance apps can offer similar guidance. Over time, this can help gamers become more disciplined savers, and investors more thoughtful about how they engage with games of chance.

My years in capital markets have shown me that no sector thrives without trust, discipline and clear rules. That lesson applies equally to gaming. Sound regulation requires holding two truths together: the private sector must be free to innovate and create jobs, and the state must protect the public and preserve market integrity. Lean too far in either direction and the system fails.

Uganda’s experience shows that sustainable growth depends on strong, flexible and risk-aware regulation backed by credible enforcement. Capital markets and gaming may differ in form, but both rely on transparency, fairness and ethical leadership. The learning curve in gaming is undeniably steep, but government support for effective, modern regulation is strong, and understanding across ministries, agencies and partners is far more aligned than it was just a few years ago. With that alignment, and with steady, principled enforcement, Uganda has a genuine opportunity to build a gaming industry that is innovative, well regulated and trusted, standing alongside its capital markets as another pillar of the country’s economic story.

After all, Las Vegas, Macau in China, Monte Carlo in Monaco, Singapore, Atlantic City, Sun City and Montecasino in South Africa show how entire cities now wear gaming and entertainment as a central part of their public identity rather than something to be hidden in secrecy.