A digital money lending company operating under the name Gold Credit is facing serious allegations for unethical and potentially illegal practices targeting borrowers and their contacts.

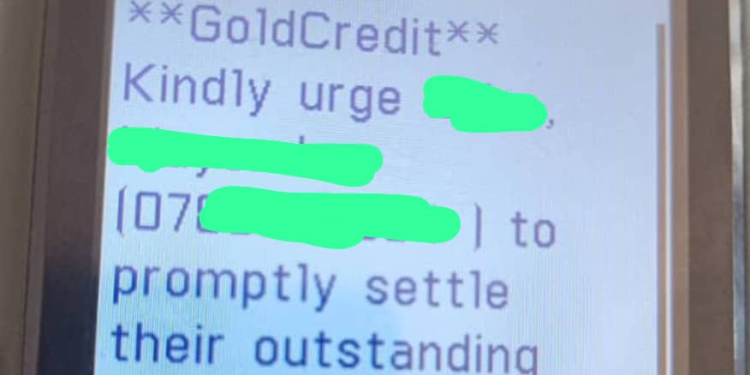

Complaints against the company highlight tactics such as unauthorized communication with the debtor’s phone contacts, threats of mobile money deductions from these contacts, and misrepresentation of official entities.

According to a formal complaint submitted by James Mukasa to the Uganda Microfinance Regulatory Authority (UMRA), the company has been engaging in disturbing practices that undermine consumer rights.

Mukasa detailed how the lender has contacted his phone contacts without his consent, sent threatening messages, and provided inaccurate debt amounts in its demand notices.

The most alarming claim is that Gold Credit has threatened to deduct funds from the mobile money accounts of these contacts if the borrower defaults.

Gold Credit reportedly also employs fake representatives claiming to be from the Criminal Investigations Department (CID), using this false affiliation to intimidate borrowers and their contacts. This tactic not only constitutes harassment but also raises questions about potential misuse of authority and identity by individuals behind the company.

Mukasa’s letter calls for immediate action from UMRA to investigate and address these practices.

He has requested that the lender be compelled to stop contacting borrowers’ phone contacts without consent, ensure demand notices reflect accurate amounts, cease all forms of harassment, and investigate the alleged misuse of CID credentials.

The allegations against Gold Credit highlight a growing concern about the regulation of digital money lending platforms in Uganda. With financial consumer protection guidelines in place, practices like these represent clear violations, emphasizing the need for stricter oversight and enforcement.

Mukasa’s concerns have also been escalated to multiple authorities, including the Criminal Investigations Directorate, the Deputy Speaker, and the Governor of the Bank of Uganda. The whistleblower warned that failure to address these grievances might prompt further legal action.

The issue serves as a reminder of the importance of protecting consumer rights and regulating digital lending platforms to prevent exploitation and uphold trust in financial services.