In an exclusive interview, a Chinese investor has shared her distressing experience with LA-CEDRI BUREAU DE CHANGE LIMITED, a forex bureau based at Garden City in Kampala, Uganda.

Tian Jinxia, also known as Candy, accuses the bureau of stealing $120,000, highlighting significant concerns about investor protection and potential corruption within Uganda’s financial and law enforcement systems.

Background and Trust

Candy, who has been a long-time customer of LA-CEDRI, described her relationship with Hilary Katende, an employee, she later discovered was the nephew of the forex bureau’s owner, Kiiza.

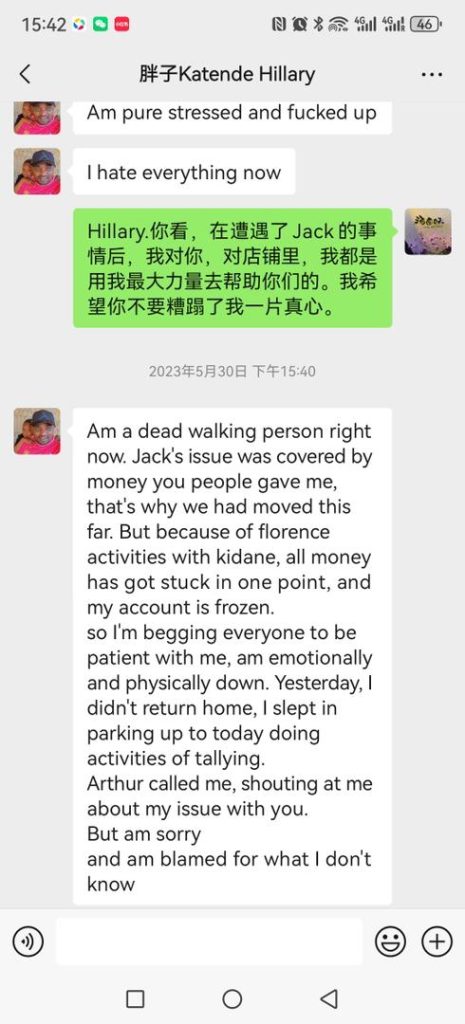

Over time, Candy frequently exchanged large sums of money at the bureau for her business operations and even lent money to Hilary to help with the bureau’s cash flow. This website confirmed this claim after obtaining WhatsApp conversations between Candy and Hilary.

In May 2023, Candy needed to transfer $120,000 to China to purchase merchandise for her business in Kampala.

“I inquired from Hilary he said I had some money in the bureau, I also went to my account in bank withdrew more money and I further picked UGX from my business and all the money totaled to $1200000,” Candy explained her ordeal.

Trusting him, Candy complied asked to send the money to China. Hilary assured her that the full amount was transferred via World Remit.

A Series of Excuses

However, Candy’s partner in China never received the funds. When she confronted Hilary, he initially confessed to facing challenges and promised to rectify the situation. Over the next few weeks, Hilary offered various excuses, including frozen accounts and considerations of selling his house to refund her.

After a month, (June 2023), desperate for a resolution, Candy sought a meeting with Kiiza, the owner of LA-CEDRI.

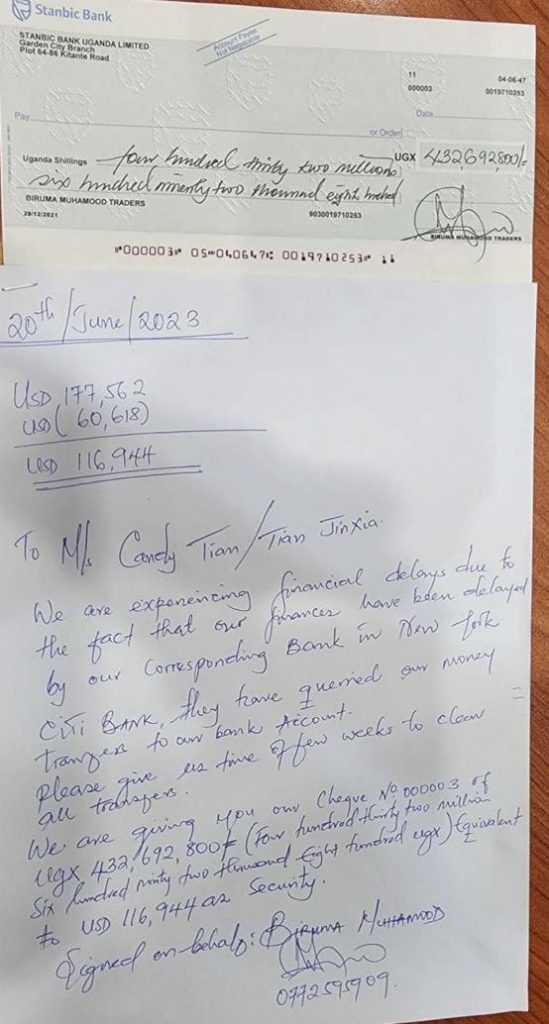

During the meeting, Kiiza apologized on behalf of his nephew and assured Candy that management was addressing the issue. However, Kiiza abruptly left the meeting before sending a stranger to give a cheque of shs 534,105,000 million.

“Amidst the meeting Kiiza stepped out and never returned. When I called him, he said he was sending me someone to give me a cheque which I would bank. The person who came was identified as Biruma Muhamood,” Candy narrates.

The Fake Cheque

The cheque, written under the name “Biruma Muhamood Traders,” was dishonored by Stanbic Bank, revealing it was worthless.

“He signed a cheque in the names of Biruma Muhamood Traders while wrote a letter in his names as a commitment. I wondered why the cheque signed by Muhamood was not in La-Cedri names. But Muhamood assured me that its ok either way I would get a refund. When I banked a cheque, the Bank said it was fake,” he said.

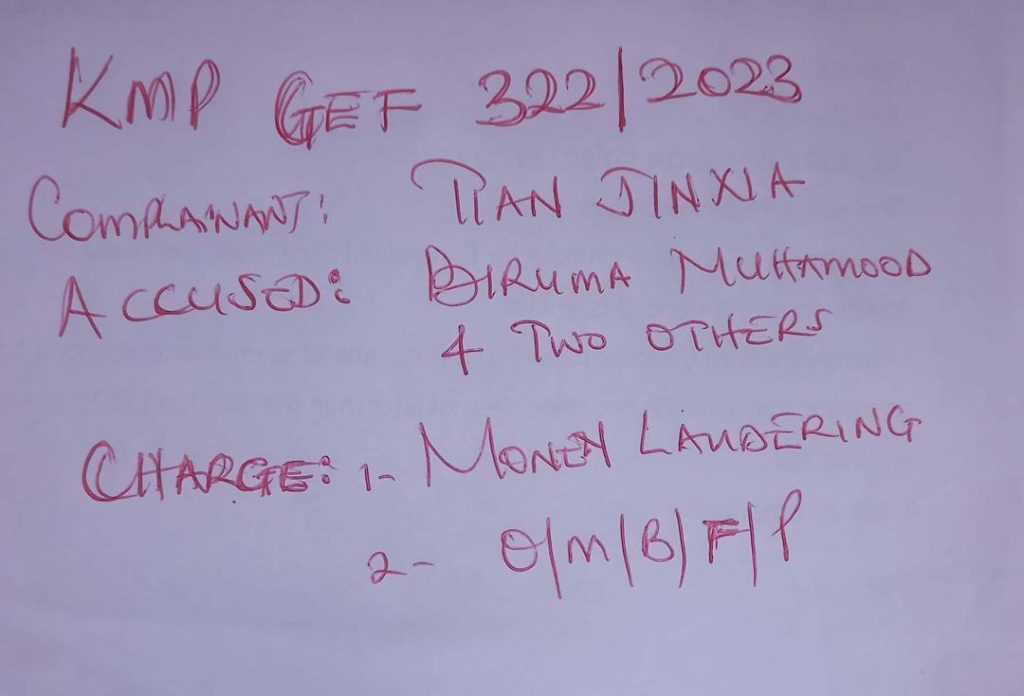

Realising she had been deceived, Candy reported the matter to the Central Police Station (CPS), filing a criminal case registered as KMP/GEF/322/2023 for obtaining money by false pretenses and theft.

Police Inaction and Alleged Corruption

Despite her efforts, the case has seen little progress. Investigation Officer Wandera Kamaradi categorized the primary charge as money laundering, which Candy believes was intended to intimidate her into abandoning her pursuit of justice. Over a year later, no suspects have been detained, and Candy suspects police corruption is at play.

“I have been a longtime customer of LA-CEDRI. I trusted Hilary with my money, but they connived to steal from me. Despite reporting to the police, I am yet to get justice,” Candy lamented.

Appeal for Justice

Candy has since appealed to Edith Nakalema, Head of the State House Investors Protection Unit, detailing her ordeal in a letter dated February 2, 2024. Her plea underscores the critical need for a thorough investigation to ensure justice and restore confidence among foreign investors.

“It is my understanding that opening a money laundering case was meant to scare me away. I have also learned that other Chinese nationals have lost substantial amounts through this syndicate. I appeal to Ugandan authorities to offer me justice and help recover my funds,” Candy stated.

Broader implications

Candy’s story resonates with other investors who have faced similar challenges in Uganda, revealing systemic issues that demand urgent attention.

The involvement of multiple individuals in the scheme and the police’s questionable handling of the case highlight the need for robust mechanisms to protect investors and ensure swift, impartial justice.

As the business community closely watches the developments in Candy’s case, her courage in speaking out may inspire other victims to come forward, shedding light on the critical need for reforms.

The Ugandan government must take decisive action to address these issues, ensuring that the country remains a safe and reliable destination for international investment.

For now, Candy remains hopeful that her appeal will lead to a comprehensive investigation and the eventual recovery of her funds. Her persistence in seeking justice is a testament to the resilience and determination of investors who continue to contribute to Uganda’s economic growth despite the challenges they face.