Business is paralysed at Nakawa Tower after traders ganged up to vehemently reject Uganda Revenue Authority (URA) ‘kangroo’ policy of levying taxes on their good using Alternative Valuation Methods (estimation).

In what traders describe as ‘unrealistic measures” the tax regulator uses “estimation method” to determine how much tax a container should be charged.

The traders who have been pressed on the wall by URA are questioning why they shouldn’t pay taxes based on the value of their goods- Transactional Value Method.

“Those who oppose are sidelined and those who painfully adhere to this policy are cleared instantly,” said a popular businessman in town whose 10 containers remain holed up in a warehouse in Namanve Industrial Park.

There is a huge queue of uncleared cargo trucks at Nakawa and in the nearest warehouses, with their owners insisting enough is enough.

“We had previously been dealing with this method of clearing taxes but Rujoki and his team have since failed to understand that most businesses were terribly hit by Covid. We are just recovering. Instead of introducing measures that favour the business environment, they are instead becoming more harsh. And we are saying enough is enough,” the frustrated business mogul added.

He asked not to be named saying the matter is sensitive and fears he would be singled out by the taxman for harassment.

A number of other traders this website interviewed have no kind words for the Rujoki Administration.

As URA noticed the business community is hell-bent on resisting the old mechanism of collecting tax, Customs officials led by Abel Kagumire have since asked the traders to provide all the paperwork- right from purchase to delivery at Nakawa so as it can be used to assess the value of goods and then determine how much tax one should pay.

“What they require from us are supportive documents. These show the owners of the consignment, what is in the container, when it was bought, where, how long and when it arrived in Uganda,” said another trader.

The process of availing this paper work (supportive documents) takes a bit of long time because at times the papers are misplaced. And once one document is missing, officials at URA will not clear the container.

But shockingly, after traders hustle to provide the documents they are informed that they should only comply with the earlier method of levying tax (estimation).

“Because the cargo is not moving, we have been forced to keep the goods in Mombasa. And every day we pay for that storage. We are losing money,” a frustrated trader remarked.

“We lodge entries Wt8 and IM7, attach the necessary documents, but still Dpc (document processing center) doesn’t release the consignments asking for more documents that are not available, so it causes delays and accumulation of demurrage at ports and bonds. When one is lucky to have a documents, dpc queries them for them to have a basis for alternative method of valuation,” a clearing agent who spoke to this website.

So question is, why ask all documents when transaction method of valuation won’t be granted?Why frustrate importers?

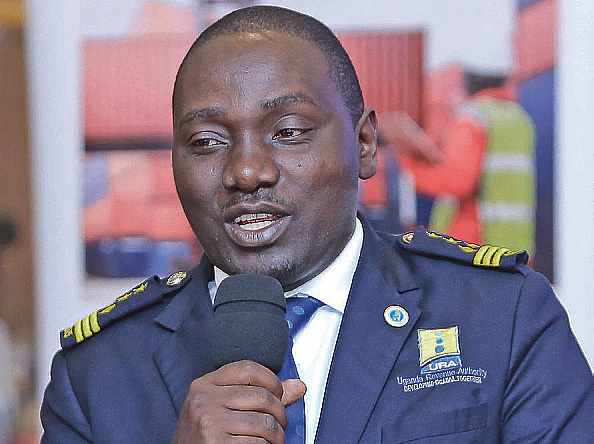

Abel Kagumire, the Commissioner Customs did not answer our numerous calls when contacted to substantiate on this issue.

The assistant commissioner Joseph Bbosa, who speaks for the authority when reached said: “The Prime method of Valuation of imported goods is the Transaction value method, where we rely on the Transaction Documents submitted by the importer to Assess taxes based on the price actually paid or payable for the goods. The transaction Documents must be genuine / authentic and they include (but not limited to) Purchase Order, Proforma invoice, Sales contract, Commercial invoice, Packing list, Bill of lading, Freight invoice, insurance certificate, certificate of origin, Regulatory certificates (if required); Export Entry from Country of export; Proof of payment eg TT. If the Importer presents all these Documents and customs is satisfied that they are Authentic then we consider their Declared values.

In case Customs is not satisfied with the presented Documents then we use Alternative Valuation methods. (Note the WCO Guidelines on Customs Valuation provided for 6 methods that must be used in sequence)

In case our staff are deviating from the laid down Valuation principles or in case the Importer is not satisfied with any Decision made by Customs, there is an Appeals procedure they can follow to have their dissatisfaction addressed.

During the Clearance Process Customs is bound by clear Service Level Agreements, so in case the Importer feels that they are being delayed / frustrated – they can also make reference to these SLA’s to ensure expeditious release of their cargo.”

Bbosa’s narrative comes days after Court declared this method of Alternative Valuation used by the URA to levy taxes on imported cars as illegal.

Court of Appeal maintained Transaction Value Method as the lawful policy which URA should be using in collecting revenue.

But an insider at Nakawa Tower revealed that the Commissioner General (CG) John Rujoki and his team have completely failed to plug revenue leakages which end up in the hands of corrupt officials who enrich themselves, and subsequently the tax collection target is affected.

“Rujoki is now squeezing the traders to be able to collect more money before closure of the financial year in July,” an insider said.

Museveni has over the years said that URA has capacity to single handedly fund the country’s domestic budget if the organization is employing patriotic officials.

Below are many of the unrealistic measures URA has introduced as a means of boosting the non tax revenue due to sharp drop in their collections.

1. Deterrent penalties: any error on documents or declaration shall be penalized to stop future errors occurring. Penalties shall be up to USD10,000 per incident. Example of such errors are misnaming items on commercial invoice, packing list.

2. Punitive Penalties: Any error on documents that is considered to lead to less taxes payable even for exempted cargo. Penalties shall beep to USD10,000 per incident. Examples of such errors are declaring less items on documents than are in container, declaring lower values on commercial invoice.

3. Non-Clearance of Shipments without all required documentation: Customs will refuse to process port entries that are missing basic transaction documents like Commercial Invoice, Packing List, Bill of Lading, Proforma Invoices, Credit Agreements/Proof of Payments etc, this shall lead to delays and extra charges in port.

4. Auctioning of Cargo: Any delayed cargo in customs bonds shall be immediately auctioned off as per the customs management act without any further warnings or notifications.