On November 9, the Central Bank issued a notice in both print and electronic media announcing the commencement of Crane Bank liquidation which aimed at winding up its affairs with the defunct bank.

Signed by Bank of Uganda Governor Emmanuel Mutebile, the notice stirred fresh debate from legal experts who warned BoU that, liquidating Crane Bank, would attract a heavy legal price since the matter is still in Supreme Court.

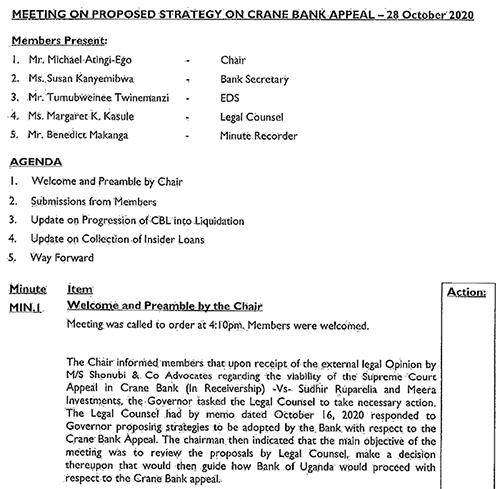

Mutebile’s communication, had been prompted by a meeting which sat on October 28, chaired by the new Deputy Governor Mr Michael Atingi-Ego, whose intention was to strategize on liquidation of Crane Bank but before to wait for Supreme Court’s decision on transition of Crane Bank from receivership to liquidation.

Mr Atingi-Ego replaced Dr Louis Kasekende whose woes of leaving BoU catapulted from the illegal sale Crane Bank.

The new Deputy Governor held the high profile meeting code named “Proposed strategy on Crane Bank Appeal” with other four BoU officials who include Ms Susan Kanyembwa, the bank secretary, Mr Tumubweinee Twinemanzi, the Executive Director Supervision, Ms Margaret K. Kasule, the bank’s Legal Counsel and Mr Benedict Makaga who took the minutes.

Leaked Minutes

Sitting at exactly 4:10pm, the five BoU officials concurred not to implement a legal advice from an external lawyer M/S Shonubi and Co Advocates who on October 6, advised that BoU should go ahead and liquidate Crane Bank.

Mr Atingi-Ego and team agreed that the process should be halted until Supreme Court gives a direction on the transition.

“Members deliberated at length and the meeting agreed BOU waits for the Supreme Court’s decision on the transition from receivership to liquidation,” reads part of the leaked minutes.

The meeting was aware that should BoU make any progress into liquidation, it would attract a serious legal repercussion.

“It was noted that the issue of progression has some legal hitches.”

However, determined to liquidate Crane Bank, the Deputy Governor and legal officer wrote to the Governor on November 4, endorsing the liquidation.

“We refer to our memo of 16th October 2020 in which we gave a number of recommendations with regard to the handling of the Crane Bank Appeal in the Supreme Court and your approval of the same, following Deputy Governor’s Memo of 4th November 2020,” Ms Kasule wrote.

Against that backdrop, Mutebile allowed the liquidation process to kick-off, something he had rejected from May 2019 because of the heavy price the progression would come with.

Further on the agenda, the meeting discussed how to protect the Crane Bank files to avoid mishaps as the transition process starts.

“With respect to one of the proposals from legal counsel, the chair noted that it is imperative for BoU to have a comprehensive and centralized record of all documents in its possession related to Crane Bank,” another extract of the leaked minutes reads.

“This need is important to support the ongoing litigation in the Supreme Court and for any other future legal actions that BoU might take in relation to Crane Bank Ltd. It was emphasized that time is of essence to gather all the documents in a centralized location.”

Financial lawyers have previously warned the Central Bank against proceeding with liquidation because it ceased being a financial institution after it was sold off to DFCU bank and its license taken away.

Crane Bank ceased to be a Financial Institution within the meaning of Financial Intelligence Authority (FIA) when its license to do banking business was taken away in January 2017 (when it was put under receivership).

The defunct bank has not been on the list of licensed financial institutions since then and therefore BOU has powers under Section 99 of the FIA to place licensed financial institutions into liquidation.

But that power only applies to financial institutions, which are legally defined under Section 3 of the FIA to mean companies licensed to do financial institutions business.

Crane Bank has no such license as of November 18th, 2020 (today) and is therefore not a financial institution that BOU can place into liquidation.