Uganda’s expenditure budgets are financed through tax collections. However, over the years, Uganda Revenue Authority (URA) has continuously failed to raise enough taxes to finance the domestic budget.

URA’s collections for the six months from July to December 2019 fell short of the target by at least 697.4 billion shillings.

The less than expected revenues is bad news to the government as it means it will not be able to implement some of the priorities planned for the 2019/2020 financial year, more so, when the money from the donors is dwindling. In turn, Government has been forced to borrow up to Shs 2.4 trillion from commercial banks to plug the revenue shortfall gap.

Previously, President Yoweri Museveni has said the country had the potential to fully fund the national budget without external financing.

However, it has now emerged that Museveni’s efforts to have the country financially self-sufficient are being thwarted by URA officials who have worked out sinister plans to divert taxes to their own pockets through well calculated tax-leakage syndicates that have enabled them enrich themselves while derailing the government’s collections target.

To cut short the tax leakages, at the start of this year, President Museveni fired the URA Commissioner General Doris Akol, replacing her with John Musinguzi Rujoki while the URA Board fired other long serving Commissioners who had been implicated in creating tax leakage outlets.

Further URA reshuffled the entire customs department across the country as a means of streamlining its operations.

How the syndicates work

The lead unscrupulous cabal that is costing URA money is headed by the enforcement team. The enforcement teams are led by two senior managers, Ivan Kakaire , the Manager of Enforcement and Peter Sebyoto , Head of Surveillance team while

Agnes Nabwire, is the Assistant Commissioner Enforcement.

This matrix, our investigations reveals set up elaborate network assisted by junior officers in the chain.

An insider privy to to the syndicate told TrumpetNews that these officers on identification of importers with massive tax bills present taxpayers with unimaginable bills to enable them clear their imports.

The harassed clients on protesting are then in turn advised to use a clearing firm of their preference as an easy remedy.

The clearing agent who works with the URA team then makes under declarations with full knowledge of the enforcement team, who in turn tell the clients that since they had been “saved” of huge taxes, they then need to divert the “saved” money to the officers, costing URA money, while the enforcement team walks away with huge sums of money.

In the second scenario that the URA insiders have told this website how officers make money at the expense of the tax body, a clearing agent, in cohorts with the officers makes declaration on behalf of a huge tax paying clients to pay taxes.

Once the enforcement team spots the huge amounts declared, the team then swoops in claiming they need to do a joint verification to certify if the declarations are right.

After making their verification, at which point fictitious amounts are thrown in implicating the clearing agent for under declaring the right amounts, an act that attracts penalties.

The panicky clearing agent is then advised to deal with the enforcement department to clear the set taxes.

The clearing agent is then cleverly directed to go to Ivan Kakaire to negotiate the penalty value. The URA official then gives a very high value to scare off the clearing agent.

The execution

Having set up all the blockages to frustrate the taxpayer, the syndicate then begins.

As the importer through his clearing agent protests the high offence penalties he is advised to make an appeal. The appeal is then made. The head of the enforcement team led by Ivan Kakaire then asks to meet the importer personally.

Once client appears before Mr. Kakaire, he is then told to abandon his clearing agent, and in turn referred to another agent who is part of the syndicate run by the URA team. One such agent who is usually used as reference is called Mr. Kinene, a former URA staff.

The now ‘tossed’ client is then assured of protection of his interests at a cost.

After agreeing with the client, the previously set penalties are then reduced, saving the client money but while costing the government money.

The new agent then facilitates the under-declaration and while excess of goods are then set free as the importer now happily walks away. For example, a client that has been poised to pay taxes of about shs 50 million ends up paying 20 million while the Enforcement Team pockets about 20m and the excited client saves 10m from the deal.

At the conclusion of the deal, the importer’s containers are escorted to the offloading area without interference of the already facilitated URA team.

As the country grapples with very low tax collections, the URA officials who do this on a daily have enriched themselves so much while services funding struggles.

Our investigation reveals that the cabal can earn shs 200 to 500 million weekly from the deals.

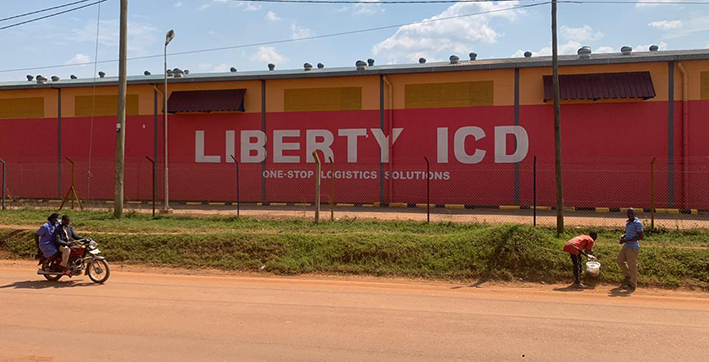

The two notorious areas of operation preferred by the corrupt URA officials have been identified as Livercot Impex Limited W0383 and Liberty ICD bonds W0248, all located in Namanve Industrial Park.

Is URA administration aware?

This website reached out to URA through Abel Kagumire, the Commissioner Customs who said these cases of tax leakages were isolated. ‘

“URA is implementing a corruption-free work ethic and as such we are closely monitoring these allegations to put a stop,” said Kagumire.

He added that any information that would help the tax body get rid of these syndicates would not be taken lightly.

He admitted that such cases have existed in the past, a reason a cleanup was instigated by the top administration.

More details will be published in part two of this investigation.