The 200 billion deal (UGX) DFCU Bank struck with BOU to acquire Crane Bank in 2017 has since gone sour. The latest information reveals that troubled DFCU bank has conceded defeat and agreed to return 22 properties which the bank occupied illegally after fraudulently acquiring Crane Bank that belonged to property mogul Sudhir Ruparelia and his Meera Investments Limited.

At this point, observes contend that DFCU could have envisaged that not even the regulator- Bank of Uganda could secure the 22 former Crane Bank branches.

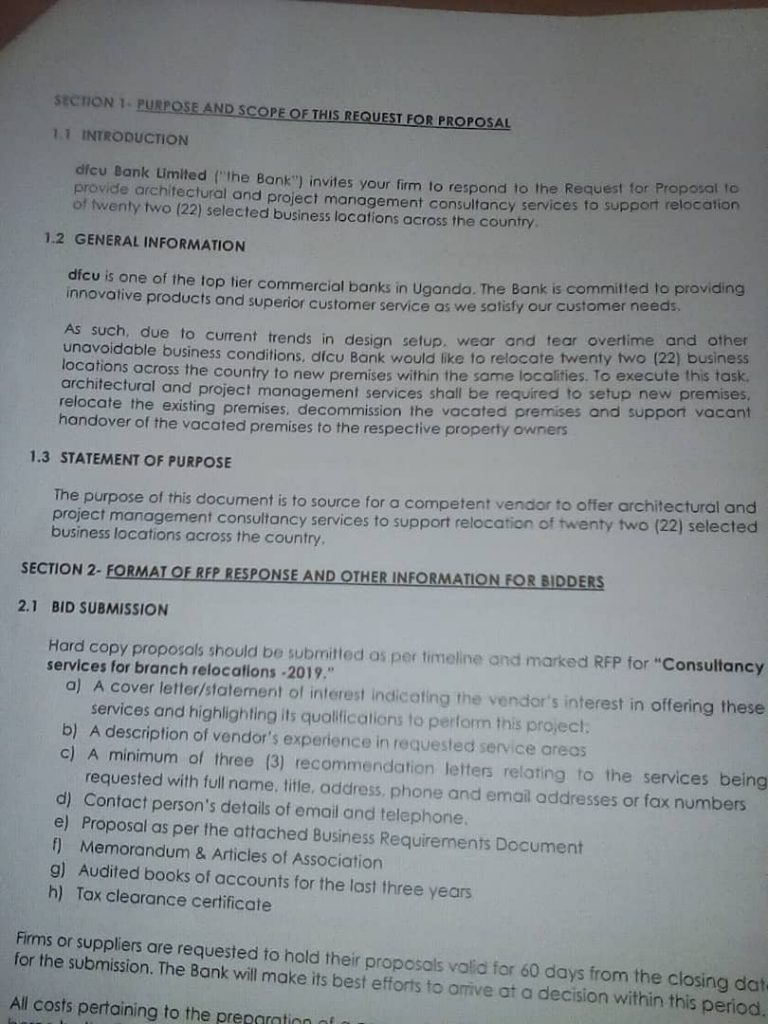

DFCU has since invited bidders that want to provide consultancy services at it seeks to relocate to new areas in various districts and towns across Uganda.

The bank has been operating its business in buildings/properties belonging to Meera Investments Limited since it acquired Crane Bank Limited in 2017.

In August it emerged that the bank was misled by city Law firm Sebalu & Lule Advocates to illegally transfer title properties into its name yet the properties belong to Meera Investments Ltd even though it had leased them to Crane Bank Limited.

Sebalu & Lule Advocates who have been barred by court from representing the same bank against city tycoon Sudhir Ruparelia for being conflicted. The law firm misled dfcu Bank to transfer leasehold titles from Crane Bank Ltd during the controversial takeover two years ago.

In a leaked document titled Transfer of former Crane Bank household properties, dated May 8, 2017, “the law firm skipped important aspects of the law including the fact that banks are not allowed to invest in business for fear of conflict of interest with their clients, apart from their main premises” banking analysts say.

“In light of the lengthy of time between the completion of date and when dfcu can vividly exercise the option to rescind the purchase of household properties, our recommendations is that the transfer be registered immediately,” reports Eagle Online.

The whole procedure was entangled with fraud as there was no consent from the Landlord (Meera Investment Ltd) before transferring the lease to another party.

“The developments in August nullified the transfer as lack of consent alone nullifies the whole procedure” as ownership belonged to Meera Investment Ltd, an independent

Background

The Bank of Uganda on October 20, 2016 closed Crane Bank Ltd, previously one of the best performing banks at Shs 200 billion to DFCU Bank, with the money being paid in installments without interest.

BoU has since come under the spotlight after the closure of seven commercial banks of which Crane Bank Ltd was one of them, with parliament’s committee on Commissions, State Authorities and State Enterprises (COSASE) nt and the Auditor General faulting BoU officials for not following the established guidelines and procedures when closing the bank.

Between 2012 and 2016, Meera leased the 46 properties to Crane Bank on different terms with the leases being duly registered as encumbrances on Meera’s freehold and mailo interest.

The lease titles were subsequently processed and issued to Crane Bank.

Crane Bank agreed to pay US$6,000 as ground rent for each of the properties effective on or before the January 1, of every year to the property owners (Meera Investments).

The lease agreements, court documents show, provided that Meera had the option to review the ground rent after the expiry of three years.

Meera had also agreed with Crane Bank under various lease agreements that in case of any breach, non-performance, or non-observance of what they had agreed on in the lease agreements, it will be lawful for Meera to seek legal redress from court.