Justine Bagyenda, the former Bank of Uganda (BoU) director for commercial banks supervision, is accused of failing National Bank of Commerce and subsequently kicking it out of business even when its owners followed procedure to recapitalize the institution as directed by the Central Bank.

The Bank was closed in September 2012 on claims that it had a shortfall of shs 300 million on the required minimum capital.

But one of the shareholders of the defunct bank, Mathew Rukikaire, wondered how they could fail to raise shs 300 billion when they were compelled to generate shs 7 billion in 4 days as requirement for capitalization by the Central Bank in order to stay operational.

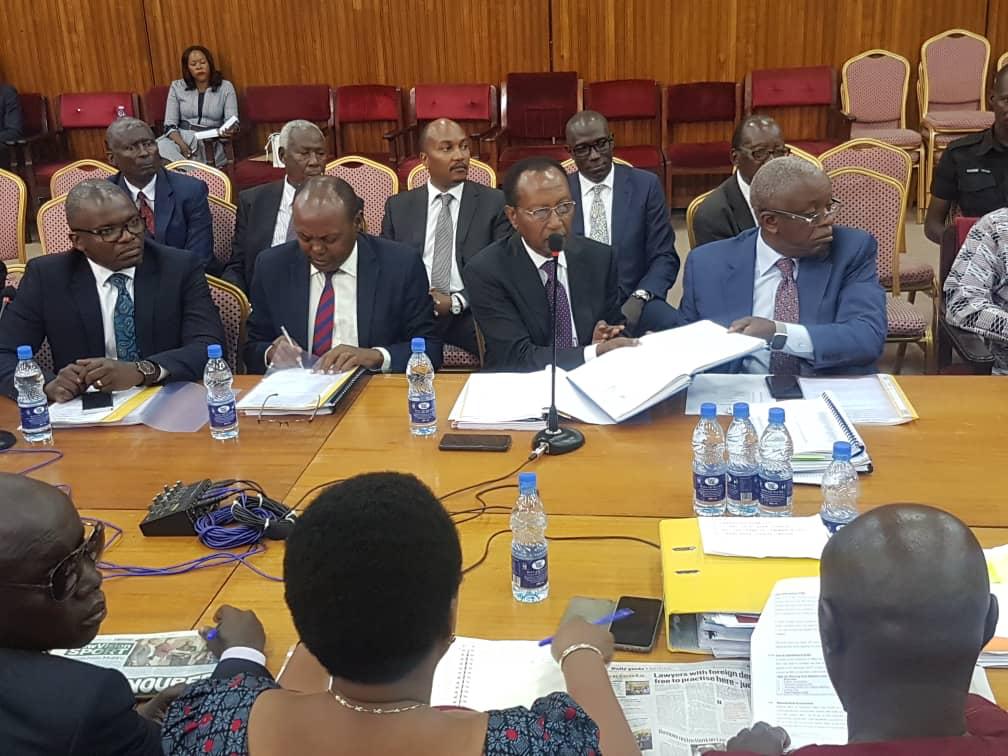

The visibly betrayed businessmen had appeared before the investigative committee of parliament- COSASE on Monday to testify against Bank of Uganda for illegally shutting their business.

The shareholders of NBC; Mr Mathew Rukikaire, former Prime Minister Amama Mbabazi and Amos Nzeyi.

Section 47 of the Financial Institutions Act states that an undercapitalised financial institution is one which holds less than 50% of the minimum capital required, meaning that with capital of Shs21b,

NBC’s capital was above the required minimum capital.

However, Mr Rukikaire testified that despite a 2012 BoU monitoring report indicating that NBC’s total assets were worth Shs21b, above the then minimum capital threshold of Shs10b, the central bank went ahead to close the bank.

“BoU continued claiming that the capital of the bank was being eroded yet this was caused by BoU itself. This was made worse when NBC was unfairly slapped with illegal civil penalties of Shs 2m per day by Ms Bagyenda. It is very clear to us that senior staff at BoU were determined to fail BoU,” he said.

“BoU asked us to raise a shortfall of Shs 7b. We raised it in 4 days. There was now a shortfall of Shs 300m and they did not even give us 1 day to raise it. We had demonstrated capacity to raise money. Why the central bank did chose to take this drastic action as the law requires them to do. The logical conclusion is that they must have had bad faith,” Mr Mbabazi added.

On his part, Mr Nzeyi narrated how he secured a Shs7b loan from the then Imperial Bank (now Exim Bank) but was then confronted by Ms Bagyenda demanding the source of the money.

Mr Nzeyi claimed he now pays Shs175m per month to Exim Bank in partial instalments to clear the outstanding loan.