Former Bank of Uganda Director in charge of Supervision Justine Bagyenda instructed DFCU bank to keep Crane Bank bad loan book off its inventory, this website has learnt.

Her directive came after DFCU took over the liabilities and Assets of Crane Bank at a fee of shs 200 billion last year in January, a transaction that has attracted a commercial litigation.

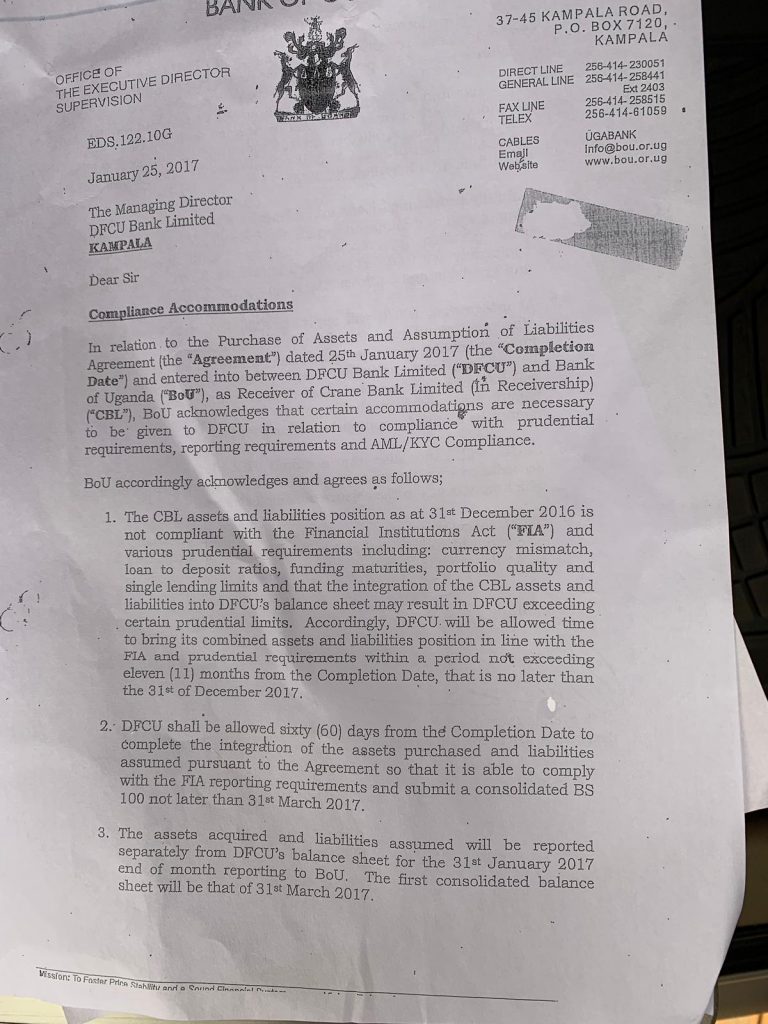

In a letter exclusively obtained by this website dated January 15, 2015, titled Compliance Accommodations, addressed to DFCU Managing Director (MD), Bagyenda says, “The assets acquired and liabilities assumed will be reported separately from the DFCU’s balance sheet for the 31st January 2017 end of month reporting to BoU. The first consolidated balance sheet will be that of 31st march 2017.”

This development further exposes Bank of Uganda officials as having crafted a plan to sell off Crane Bank without following procedures as required by the law.

Bagyenda who was in charge of Supervision of Commercial Bank is blamed to have presided over the fall of Crane Bank.

She has since been sacked.

The dirty dealings between Bank of Uganda and DFCU over the sale of Crane Bank which belonged to businessman Sudhir Ruparelia were further exposed by Auditor General’s report whose findings indicated that the defunct Bank was never grossly insolvent as indicated by the Mutebile Administration.

Below we produce Bagyenda’s letter ordering DFCU keep Crane Bank bad book off the records.

In relation to the purchase of assets and assumption of liabilities agreement (the “Agreement”) dated 25th January 2017 (the “completion date”) and entered into between DFCU Bank Limited (“DFCU”) andBank of Uganda (“BoU”), as Receiver of Crane Bank Limited (in receivership) (“CBL”), BoU acknowledges that certain accommodations are necessary to be given to DFCU in relation to compliance with prudential requirements, reporting requirements and AML/KYC Compliance.

BoU accordingly acknowledges and agrees as follows;

- The CBL assets and liabilities position as at 31st December 2016 is not compliant with the Financial Institutions Act (“FIA”) and various prudential requirements including: currency mismatch, loan to deposit ratios, funding maturities, portfolio quality and single lending limits and that the integration of the CBL assets and liabilities into DFCU’s balance sheet may result in DFCU exceeding certain prudential limits. Accordingly DFCU will be allowed time to bring its combined assets and liabilities position in line with the FIA and prudential requirements within a period not exceeding eleven (11)months from the completion Date, that is no later than the 31st December 2017.

- DFCU shall be allowed sixty (60) days from the completion date to complete the integration of the assets purchased and liabilities assumed pursuant to the Agreement so that it is able to comply with the FIA reporting requirements and submit a consolidated BS 100 not later than 31st March 2017

- The assets acquired and liabilities assumed will be reported separately from the DFCU’s balance sheet for the 31st January 2017 end of month reporting to BoU. The first consolidated balance sheet will be that of 31st march 2017

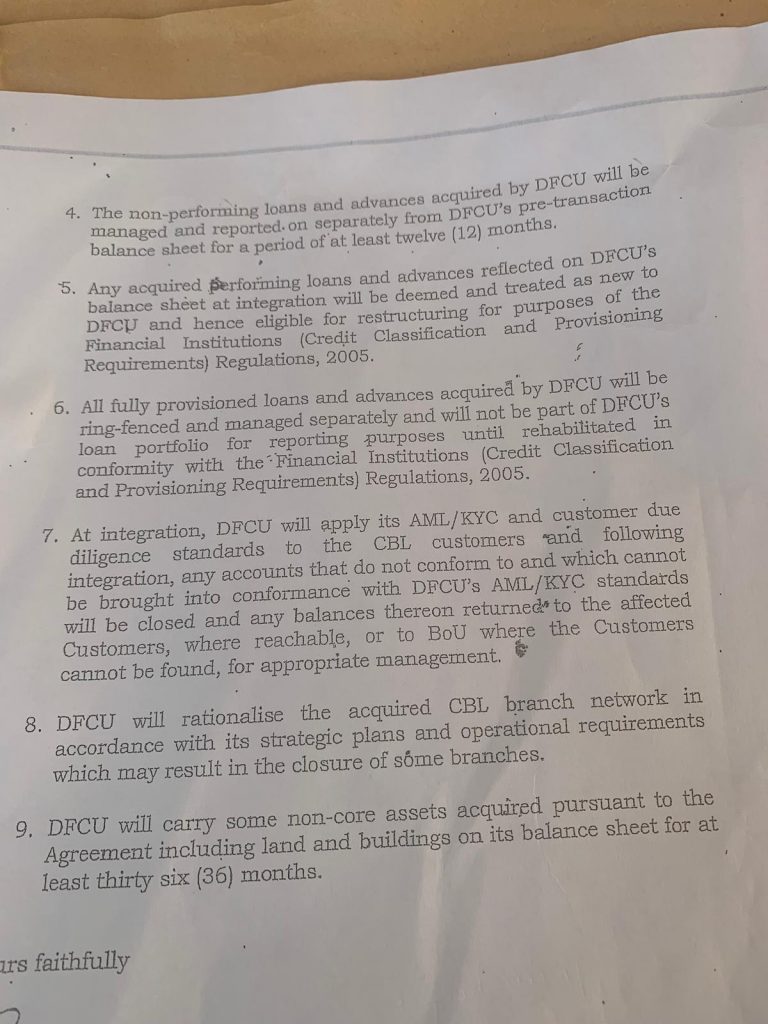

- The non-performing loans and advances acquired by DFCU will be managed and reported on separately from DFCU’s pre-transaction balance sheet for a period of at least twelve (12) months

- Any acquired performing loans and advances reflected on DFCU’s balance sheet at integration will be deemed and treated as new to DFCU and hence eligible for restricting for purposes of financialinstitutions (credit classification and provisioning requirements) Regulation 2005.

- Any fully provisioned loans and advances acquired by DCU will bering-fenced and managed separately and will not be part of DFCU’s loan portfolio for reporting purposes until rehabilitated in conformity with the Financial Institutions (Credit classification and provisioning requirements) Regulations, 2005

- At integration, DFCU will apply its AML/KYC and customer due diligence standards to CBL customers and following integration, any accounts that do not conform to and which cannot be brought into conformance with DFCU’s AML/KYC standards will be closed and any balances thereon returned to the affected customers, where reachable, or to BoU where the customers cannot be found, for appropriate management

- DFCU will rationalize the acquired CBL branch network in accordance with its strategic plans and operational requirements which may result in the closure of some branches

- DFCU will carry some non-core assets acquired pursuant to the Agreement including land and buildings on its balance sheet for at least thirty six (36) months