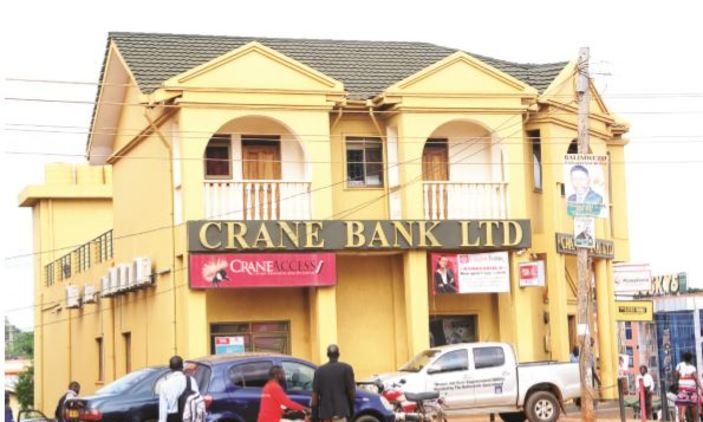

Crane Bank had become insolvent, that was the reason highlighted by the Central Bank justifying why it sold Sudhir Ruparelia’s Bank to DFCU in January Last year.

In October 2016, Bank of Uganda (BoU) took over the operations of Crane Bank.

Whereas Sudhir contested the sale of Crane Bank in Courts of Law, it later emerged that Bank of Uganda sold the financial institution cheaply, this was according to the leaked sale agreement which legal experts say it was riddled with loopholes.

Again a list of influential Ugandans with huge loans in Crane Bank has since been doing rounds.

The list contains popular filthy rich politicians, successful businessmen, renowned journalists and many more.

This comes after PricewaterhouseCoopers (PwC), an international audit firm conducted a forensic audit.

Titled: Report on the compilation of financial information of Crane Bank as at 20 October 2016, it highlights more than 30 business people and firms who took out huge loans which they had not yet cleared at the time of the takeover.

They include prominent politicians such as Sam Kutesa, the Foreign Affairs minister (Shs 1 billion); John Nasasira the former minister of Works (Shs 400 million); Robert Mwesigwa Rukaari, a businessman (Shs 2.2 billion) and Media honchos Andrew Mwenda (Shs 256 million) and Robert Kabushenga (Shs 176 million).

Others are: Ronnie Balya, the former director general of Internal Security Organisation (ISO) who had an outstanding balance of Shs562 million. Mukesh Shukla of Shumuk Group of Companies ( Shs2b).

Robert Kabonero, owns businesses including casinos had a loan Shs 2 billion while Patrick Bitature of Simba Telecom had an outstanding loan amount of Shs12b.

Spencon, a major road construction firm, had an outstanding loan balance of Shs22b while Grapes Limited, which is owned by Amina Moghe Hersi had an unpaid balance of shs11billion.

Imperial Botanical Beach Hotel had also acquired a $4.3m (Shs 15b) while Fountain Publishers, owned by James Tumusiime, also had an outstanding balance of Shs1.4b.

Kuku Foods, who run the KFC franchise in Uganda, also had a loan facility of Shs500m from the bank.

Goodra Behakanira Tumusiime, the owner of Bwebajja Hotel Complex along Entebbe Road had an outstanding loan balance of Shs 6.9b. Steel and Tube Industries had also acquired a loan of Shs 6 billion.

Property developer Christine Nabukeera of Nabukeera Plaza was owed Shs 18 billion the bank.

Imperial Botanical hotel owned t by Karim Hirji owed the bank over Shs 14bn while Haris international, the makers of Rock Boom energy drink had a loan of Shs 8 billion.

Ntaganda Ephraim, a city businessman was yet to repay Shs 3 billion and so was Esther Ampumuza, a businesswoman who had an outstanding balance of Shs 600m on her loan.

(NilePost)